New York Times Offers Comprehensive Look at Taxation in America

/

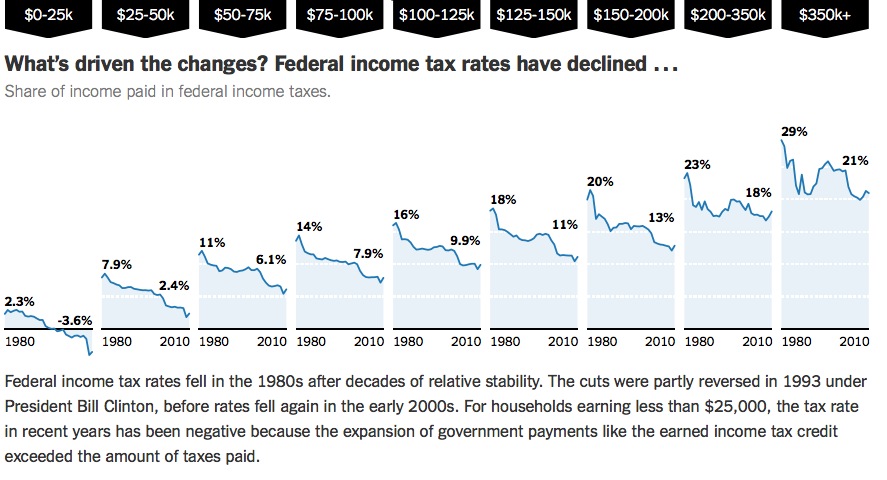

Rush Limbaugh, Grover Norquist and the Republican party aside don’t help the American people understand that most Americans in 2010 paid far less in total taxes — federal, state and local — than they would have paid in 1980, writes the New York Times.

The greatest benefit of lower taxes went to households earing more than $200,000. Middle-income households benefited also, with the result that more than 85 percent of households earning above $25,000 paid less taxes in total than comparable households in 1980.

Lower-income households, however, saved little or nothing. Many pay no federal income taxes, but they do pay a range of other levies, like federal payroll taxes, state sales taxes and local property taxes. Only about half of taxpaying households with incomes below $25,000 paid less in 2010.

Today’s New York Times has published this extensive set of graphs, as an information tool in the current debates in Congress about federal taxes, the sequestration and ‘fiscal cliff’. Rather than looking at only the federal tax budget, this data examines a total view of taxation in America and includes the impact of federal, state and local taxes on American households. Read more about how the Times compiled this data.

In the rancorous debates and accusations that are ripping apart our country, Anne of Carversville has always tried to present a fair and accurate assessment of our social policies. Our readers are very concerned about fairness and that includes our fiscally conservative readers — most of them now considered rinos (Republican in name only). Whatever our political affiliation, we have a progressive social conscience and seek a sense of fairness in America. Hopefully, these charts will help educate us about the reality of current taxation policy in America. Especially in conversations about the scope of the federal government, the truth is far different than the talking heads suggest on television, online and the written media. ~ Anne